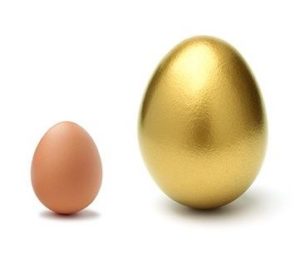

Many Happy Returns

At LBMC, we create investment solutions by considering all the components that affect your financial well-being. Our independent, fee-only investment specialists provide financial peace of mind through coordinated investment and tax advice. Your investment success is encouraged by comprehensive counsel that keeps you moving forward. With the resources of the LBMC Family of Companies, we customize services to suit your needs, and do it with the utmost integrity, confidentiality, and personal attention for a relationship you can invest in.

Our independent, fee-only specialists use coordinated investment and tax advice to create customized investment solutions. We consider all the components that affect your financial well-being and provide you peace of mind.

LBMC Investment Advisors Mobile App

Download the LBMC IA Mobile app today!

See how our Mobile App helps you manage your finances from the palm of your hand.

Clients can review their financial picture and interact with a financial advisor – all in a secure and easy to use mobile app. This app provides a financial dashboard of the client’s finances, document vault, current reports, budgeting tools and more.

- Interactive dashboard: Get a financial picture with account balances, performance, and asset allocation.

- Dynamic reports: Conveniently access current investment information and quarterly reports.

- Document vault: Securely send and receive files with a financial advisor

- Quarterly newsletters: Keep up-to-date with quarterly insights.

You can access your LBMC Investment Advisors App on your iPhone®, iPad® or Android® devices. Simply type in “LBMC” in the Apple App Store or Google Play Store, and look for the icon below:

Third-party rankings and recognition from rating services or publications are no guarantee of future investment success. Working with a highly rated advisor does not ensure that a client or prospective client will experience a higher level of performance or results. These ratings should not be construed as an endorsement of the advisor or by any client nor are they representative of any one client’s evaluation. No fee was paid for consideration of any ranking or award. Disclosure of the criteria used in making these rankings is available upon request.

Investment Check-Up

Before you start on any journey, you must understand where you are currently and then map where you want to go. At LBMC, we begin each relationship with an Investment Check-Up, a service to benefit those who are unsure of the nature of the assets they have and how those assets fit together.

With years of investment experience, combined with an in-depth knowledge of both your financial situation and the relevant income tax and estate and gift tax laws, we can accurately pinpoint where you are, what’s working for you, and what are areas of concern. We put it all in writing with recommendations for enhancing your investment portfolio. You get the benefit of face-to-face personalized consultation that results in a roadmap for your financial future.

Investment Check-Up includes:

- An Asset Allocation Chart specific to your holdings.

- An Investment Position Review that examines each of your holdings for past performance, risk, security overlap, sector weighing, and expense.

- A letter containing specific areas of concern for fine tuning your portfolio.

- An Investment Consultation review session.

All we need from you:

- Account statements for your various accounts

- Personal financial statement, if available

Investment Process

Our investment professionals focus on diversification within and across a wide variety of assets while keeping an eye on expenses. We are always mindful of taxes and look for ways to add value for our clients. Over the years, we become deeply involved in all aspects of our clients’ financial lives.

Investment Process details include:

- Listen to Your Objectives At LBMC, we don’t believe in cookie-cutter solutions. That’s why your investment plan is crafted specifically for your needs. In order to best serve you, we begin by listening as you describe your goals and objectives.

- Create a Strategy that Works To formulate a plan that meets your needs, we’ll begin by analyzing your current asset allocation for both performance and volatility. We will then build a list of recommendations with careful regard for how they individually and collectively advance your position. We pay particular attention to the tax aspects of your investment choices.

- Implement Your Strategy Whether using exchange-traded or mutual funds, we’ll transform your strategies into a comprehensive initiative geared to meet your current income needs and future capital requirements.

- Review Your Plan Continually Over time, your needs will change and new opportunities will arise. As our client, we consider it our responsibility to look out for your best interests throughout the years, always seeking the best ways to achieve your long-term investment objectives.

Statement of Philosophy

Our focus is on Wealth Management. We believe success in properly managing client assets is not measured by performance statistics, but by our clients’ achieving their goals.

We believe that successful wealth management is about understanding and managing risk. Instead of chasing hot funds and betting on hot markets, we focus on developing a disciplined investment strategy that will provide our clients the investment returns they need with the least risk possible to their assets.

Our clients are not speculative, high-risk investors. Some are fiduciaries of corporate retirement plans, non-profit institutions, trusts or estates. Others are individuals who have already established themselves financially. All seek to grow their assets over time while avoiding the numerous risks that abound in today’s investment environment.

We are successful because we understand the unique needs of our clients and because we are ideally positioned to respond to those needs. As an independent, fee-based firm we do not represent investment or insurance providers, nor do we receive commissions for recommending investments or trading securities.

We answer only to our clients, ensuring that the investments we recommend to them are those that we believe to be appropriate for them.

Our reality is a simple one: We succeed only when our clients succeed.